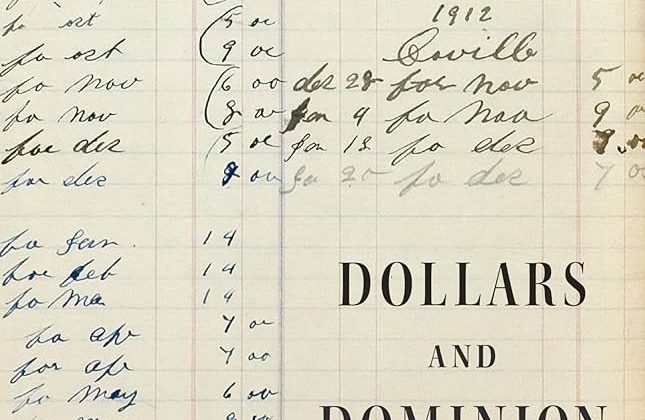

Mary Bridges is an Ernest May Fellow in History and Policy at Harvard Kennedy School’s Belfer Center for Science and International Affairs. This interview is based on her new book, Dollars and Dominion: US Bankers and the Making of a Superpower (Princeton University Press, 2024).

JF: What led you to write Dollars and Dominion?

MB: I wanted to understand how US companies became global. In 1900, only a handful of US firms had an international presence. By the mid-twentieth century, US multinational firms had become foundational to the functioning of global capitalism, and I wanted to understand how that transformation happened. I did not set out to become a banking historian, but I worked as a reporter before graduate school, and the adage “follow the money” must have stuck with me.

The more research I did, the more I was struck by how the early expansion of US banking overseas shaped US global power. Examining the story of institutions like the International Banking Corporation and their role in places like the Philippines offered a new perspective on the roots of US economic influence worldwide.

JF: In 2 sentences, what is the argument of Dollars and Dominion?

MB: Dollars and Dominion argues that the expansion of US banking overseas in the early 20th century provided a foundational infrastructure that allowed US influence to take root in numerous locations around the world. This banking expansion wasn’t just about profits but was deeply intertwined with US imperial ambitions, shaping and often reinforcing existing power structures abroad and at home.

JF: Why do we need to read Dollars and Dominion?

MB: Dollars and Dominion offers a new perspective on the roots of US global power, showing how financial institutions played a crucial role in expanding the nation’s influence. It helps us understand current debates about the role of finance in society by tracing how the intertwining of banking, politics, and imperial ambitions shaped our modern financial system.

JF: Why and when did you become an American historian?

MB: I have long been interested in how the US government and US businesses work in tandem—or opposition—to advance different visions of US global power. I lived in the Middle East briefly after college and was struck by how frequently I encountered the detritus of USAID and US development projects. While public attitudes toward the US government were often polarized, numerous US brands—Apple, Starbucks, and even Krispy Kreme—carried prestige. I returned to the United States for graduate school in international relations with a plan to study US development projects overseas during the Cold War. However, as often happens with historians, I constantly sought answers in earlier periods and ended up at the turn of the twentieth century.

JF: What is your next project?

MB: I’m starting a new research project to understand how US infrastructure building overseas hardwired US influence into landscapes and markets worldwide. The project moves chronologically, from the construction of the Panama Canal to the creation of the early internet, to understand how technocratic expertise shaped communities’ access to resources. The book focuses on the convergence of three key professions—engineering, diplomacy, and finance—to understand how technocrats’ visions of “progress” and “free enterprise” manifest in their construction plans. The book also asks: How were the infrastructure projects translated into financial products, such as bonds and other debt instruments, that could be standardized, graded, and traded on secondary markets? When complete, the project seeks to understand how a small group of engineers and bankers collaborated to design interventions and configure new expressions of US global power modeled on European imperialism.

JF: Thanks, Mary!